What do you purchase (Asset vs Business)?

FRS 103(R) Business Combinations determines if an acquired set of activities and assets is a business;

- A business includes an input and a substantive process that together significantly contribute to the ability to create output. e.g. special knowledge and skills, (unlike operating pools in real estate, shipping industry).

- Optional fair values concentration test: concentrated in a single or a group of similar identifiable asset.

Different accounting treatments accordingly;

- An asset: subject to impairment test.

- A business: is required to perform purchase price allocation during the consolidation process.

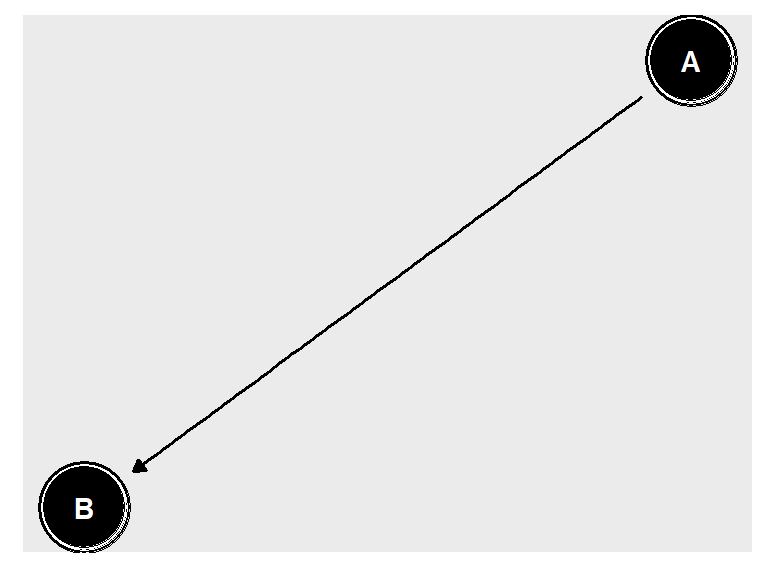

Do you have control?

FRS 110 determines the control concept;

- Power over the decision-making of relevant process and activities

- Returns

- Combination of power and returns (principal vs agent)

Powers -> Substantial rights -> Voting;

- Majority voting rights

- Contractual arrangements (among investors)

- Potential voting rights (options regardless of managment intention)

- De facto control (many minority investors)

- Purpose and designed SPV (expectation and motivation)

- Proof of the power of disposal (run BOD regardless of voting)

Substantial rights;

- Not protective

- Possibility of exercising (timing and feasibility)

Am I exempted from consolidation?

- Immaterial entities

- Subsidiaries recorded at FVTPL

How to consolidate?

Consolidation process;

- Convert local GAAP to IFRS in a single financial statements in terms of Recognition, Measurement, and Presentation.

- Align financial year end (a same reporting date or within 3 months)

- Currency translation (BS: close rate, PL: average rate, Equity: historical rate, translation reserve, OCI)

- Consolidation forms.

- Change consolidation levels (stepup acquisition or disposal)

- Intra-group transactions (IFRS: buyer tax rate, US: seller tax rate)

Consolidation forms;

- FRS 109: AFS at cost

- FRS 111 JO: Give parties rights to specific assets and obligations

- FRS 28(R) JV: Establish a seperate vehicle via the joint arrangement (no direct access to its assets)

- FRS 28(R) Associate: Significant influence, proportional consoldiation

- FRS 110 Subsidiries: Control, 100% consolidation

- FRS 105 Discontinued Operations:

Purchase price (include both condideration and others, list others as follows);

- Transaction cost (DR: Expense, CR: Investment, not directly attributable to the acquisition)

- Contingent payments relating to post-acquisition

- Indemnification assets (due dilligence risk such as lawsuit, DR: Assets, CR: Provision)

- Pre-existing relationships (supplier contracts)

- Re-acquired rights (distribution rights)

- Leasing contracts

- Deferred tax

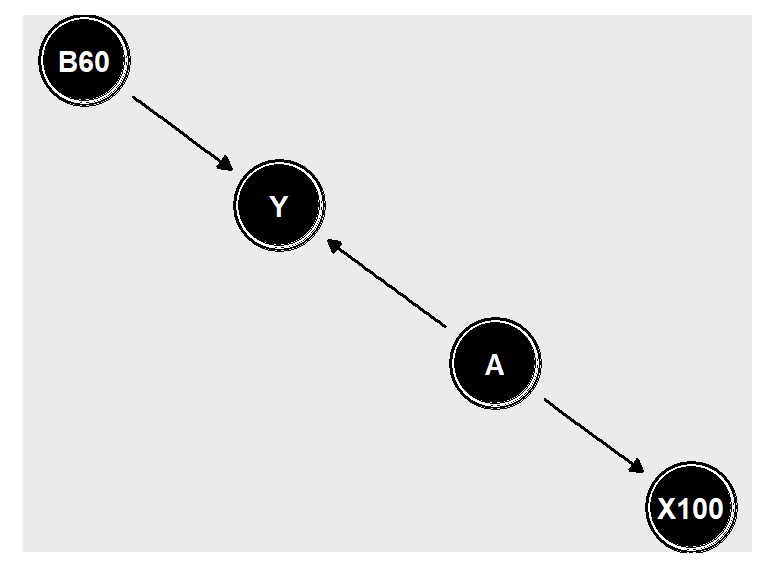

A faces a loss or penalty due to the contract with B. A intends to acquire B to imporve its financial position.

- Settlement is not done to obtain control over B upon acquisition (settlement recorded in P/L).

- Pre-existing relationships become an inter-company relationship, and is eliminated upon acquisition (must remove).

- Acquisition consideration = price - settlement (impact on goodwill)

A granted an exclusive disribution right to B (franchise).

- The re-acquired right is treated as IA.

- Settlement in P/L: lower of unfavourable component (6/10 new right vs 6/10 old right) and termination penalty

- Difference (unfavourable component vs termination penalty) is treated as goodwill

- Acquisition consideration includes IA and goodwill.

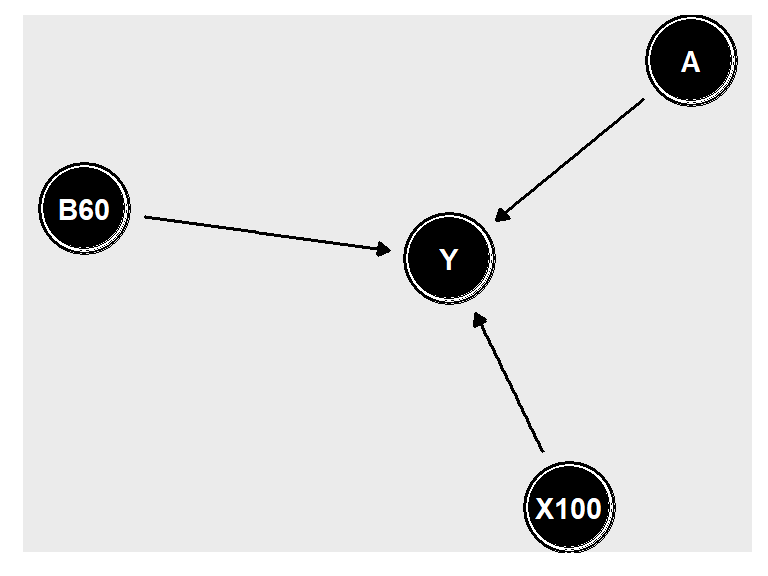

Purchase price allocation (Consideration);

- Cash

- Shares

- Previous interest

- NCI

- Fair value of assets (deferred tax)

- Contigent consideration (Earn-out (Yes): Future, Indemnification (No): Past)

- Goodwill

Earn-out contingent consideration;

- Cash settlement: libility at FV (must be included in group FS, FV based on probabilities, movement recoded in P/L)

- Sahre settlement: initially recorded at FV, subsequently equity without remeasurement.

Share-based payment;

- Share acquisition: A part of purchase consideration

- Share incentive: Post-acquisition expenses

- Replace the exisiting plan (Payment vs Vested, <= Consideration, > P/L as post-combination cost)

How much to consolidate?

Joint operation;

- % profit sharing in contracts

- line-by-line accounting based on %

- intra group transactions elimination

Joint venture;

- Equity accounting: Investment (dividend, profit), FV assets (depreciation, tax), contingent liabilities, goodwill (impariment).

Associates;

- Equity accounting

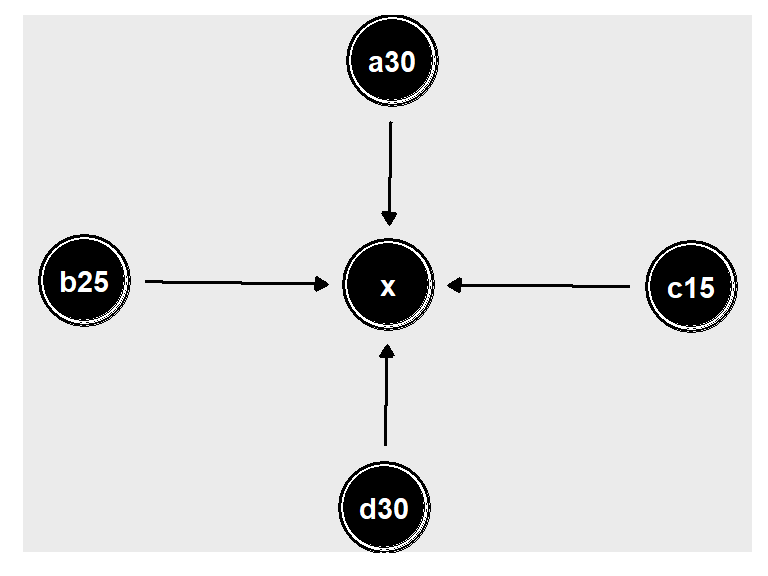

If B, C, D have a joint agreement, C has to prepares using equity accounting too.

Subsidiries;

- Previously held interest is not remeasured until it becomes a subsidiary

- AFS to Associate (Dr: Current investment, Cr: Previous equity, Cr: Cash)

- Associate to Subsidiary (DR: Investment, Cr: P/L, as if sell buy back, then consolidation allocation).

- Same treatment in the case of disposal.

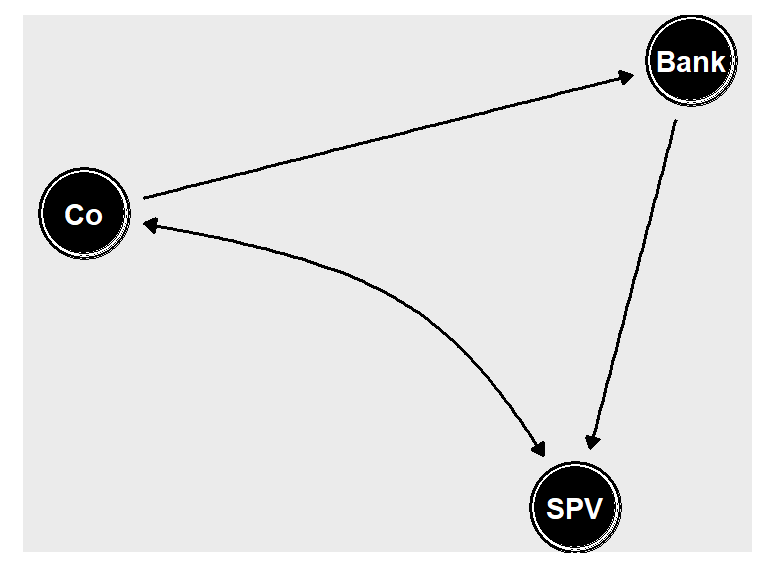

If Co issues FG to the Bank, Co still has risks and rewards. Thus, Co has to consolidate SPV with 100% NCI.

Loss of control after partial disposal;

- AFS reserve recycles to P/L (a part of disposal gain)

- Revaluation reserve recycles to R/E (not disposal gain)

- Accounting treatment should be same (recognize a full gain).

To read more, please refer to 2017 Under control Applying IFRS 10