This part covers linear regression. Non-linear relationship between dependent variable and predictors will not be explored here. Target variable is not transformed due to many 0 in the dataset.

Backward stepwise regression

Three predictors selected by backward stepwise are purchases cost of goods, wages sales inside, and wages warehouse.

Subset selection object

Call: regsubsets.formula(revenue ~ ., data = df_model, nbest = 1, nvmax = 3,

method = "backward")

11 Variables (and intercept)

Forced in Forced out

purchases_cost_of_goods FALSE FALSE

wages_sales_inside FALSE FALSE

payroll_tax_expenses FALSE FALSE

wages_office_staff FALSE FALSE

wages_warehouse FALSE FALSE

conferences_and_seminars FALSE FALSE

supplies FALSE FALSE

dues_and_subscriptions FALSE FALSE

interest_expense FALSE FALSE

maintenance_janitorial FALSE FALSE

accounting_fees FALSE FALSE

1 subsets of each size up to 3

Selection Algorithm: backwardLinear regression

model_lm2 is selected after compared four lm models.

- model_lm vs model_lm1: no siginificant difference. One predictor (purchase) is sufficient.

- model_lm1 vs model_lm2: agrees to backward stepwise. Additional two predictors have some impact on target.

- model_lm1 vs model_lm3: different from random forest. Suggest interest expense and accoutning fees are not important.

- model_lm2 vs model_lm3: different from random forest. Interaction is not impactful.

Analysis of Variance Table

Model 1: revenue ~ purchases_cost_of_goods

Model 2: revenue ~ purchases_cost_of_goods + wages_sales_inside + wages_warehouse

Res.Df RSS Df Sum of Sq F Pr(>F)

1 182 88558881

2 180 84618271 2 3940610 4.1912 0.01663 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1 Analysis of Variance Table

Model 1: revenue ~ purchases_cost_of_goods

Model 2: revenue ~ purchases_cost_of_goods * interest_expense + accounting_fees

Res.Df RSS Df Sum of Sq F Pr(>F)

1 182 88558881

2 179 88275037 3 283844 0.1919 0.9018 Analysis of Variance Table

Model 1: revenue ~ purchases_cost_of_goods + wages_sales_inside + wages_warehouse

Model 2: revenue ~ purchases_cost_of_goods * interest_expense + accounting_fees

Res.Df RSS Df Sum of Sq F Pr(>F)

1 180 84618271

2 179 88275037 1 -3656766 5 % 95 %

(Intercept) 7.3369556 206.9033872

purchases_cost_of_goods 2.1643745 2.2592575

wages_sales_inside -1.2743144 -0.1106398

wages_warehouse -0.5323339 0.1048621

Model diagnostic

Assumptions

Call:

lm(formula = revenue ~ purchases_cost_of_goods + wages_sales_inside +

wages_warehouse, data = df_model)

Residuals:

Min 1Q Median 3Q Max

-3295.5 -107.1 -107.1 66.0 4972.7

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 107.12017 60.35167 1.775 0.0776 .

purchases_cost_of_goods 2.21182 0.02869 77.083 <2e-16 ***

wages_sales_inside -0.69248 0.35191 -1.968 0.0506 .

wages_warehouse -0.21374 0.19270 -1.109 0.2688

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 685.6 on 180 degrees of freedom

Multiple R-squared: 0.9774, Adjusted R-squared: 0.9771

F-statistic: 2600 on 3 and 180 DF, p-value: < 2.2e-16

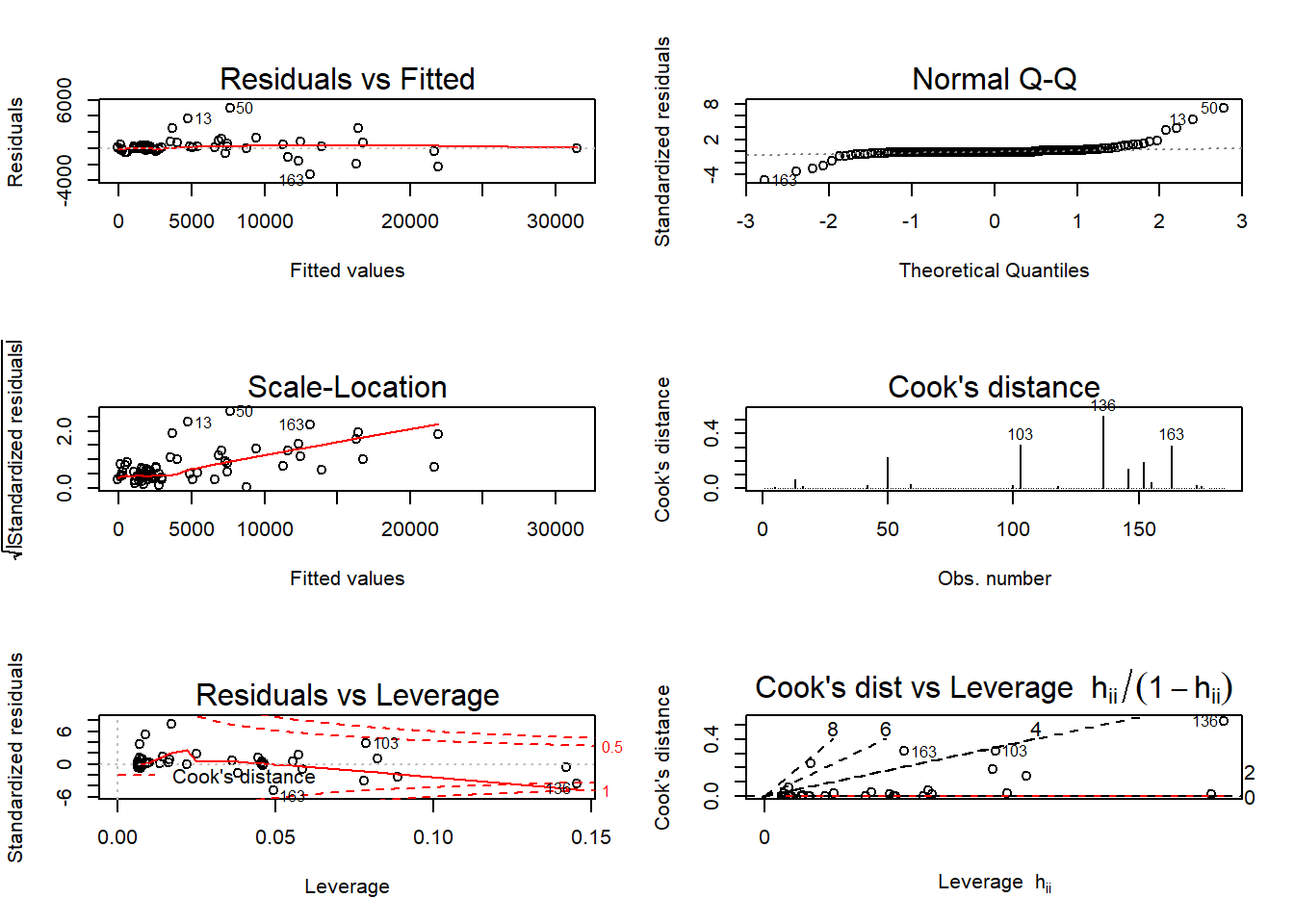

ASSESSMENT OF THE LINEAR MODEL ASSUMPTIONS

USING THE GLOBAL TEST ON 4 DEGREES-OF-FREEDOM:

Level of Significance = 0.05

Call:

gvlma::gvlma(x = model_lm2)

Value p-value Decision

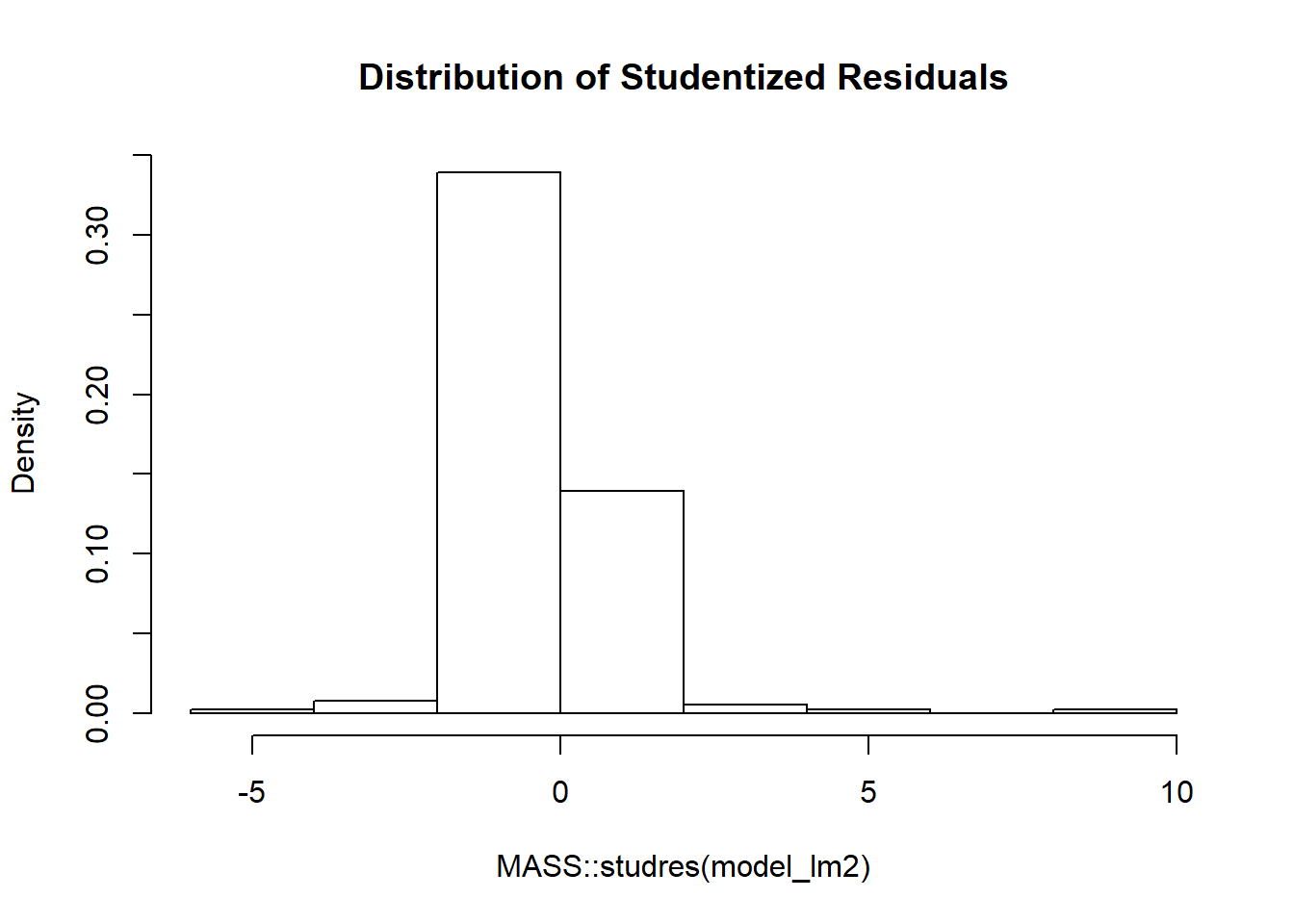

Global Stat 4559.600 0.000e+00 Assumptions NOT satisfied!

Skewness 206.108 0.000e+00 Assumptions NOT satisfied!

Kurtosis 4331.691 0.000e+00 Assumptions NOT satisfied!

Link Function 19.572 9.689e-06 Assumptions NOT satisfied!

Heteroscedasticity 2.229 1.354e-01 Assumptions acceptable.Outliers

rstudent unadjusted p-value Bonferroni p

50 8.700994 2.1014e-15 3.8455e-13

13 5.809475 2.8107e-08 5.1435e-06

163 -5.285148 3.6238e-07 6.6316e-05

103 3.999397 9.2791e-05 1.6981e-02

100 3.799137 1.9878e-04 3.6377e-02

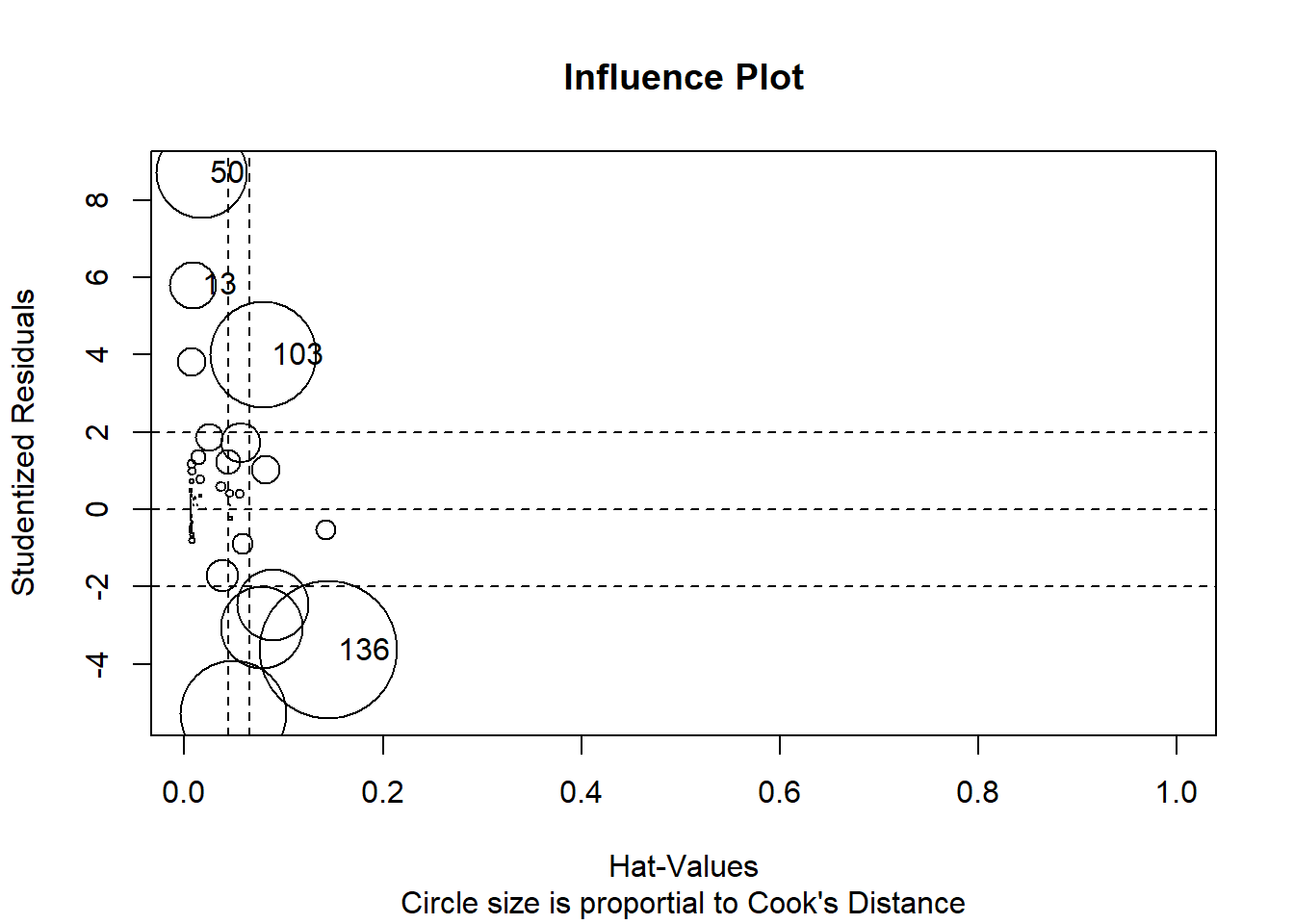

Influential Observations

StudRes Hat CookD

13 5.809475 0.008581228 0.06178868

50 8.700994 0.016838320 0.22907764

103 3.999397 0.078728017 0.31544174

136 -3.643572 0.145535897 0.52919937

177 NaN 1.000000000 NaNNormality of Residuals

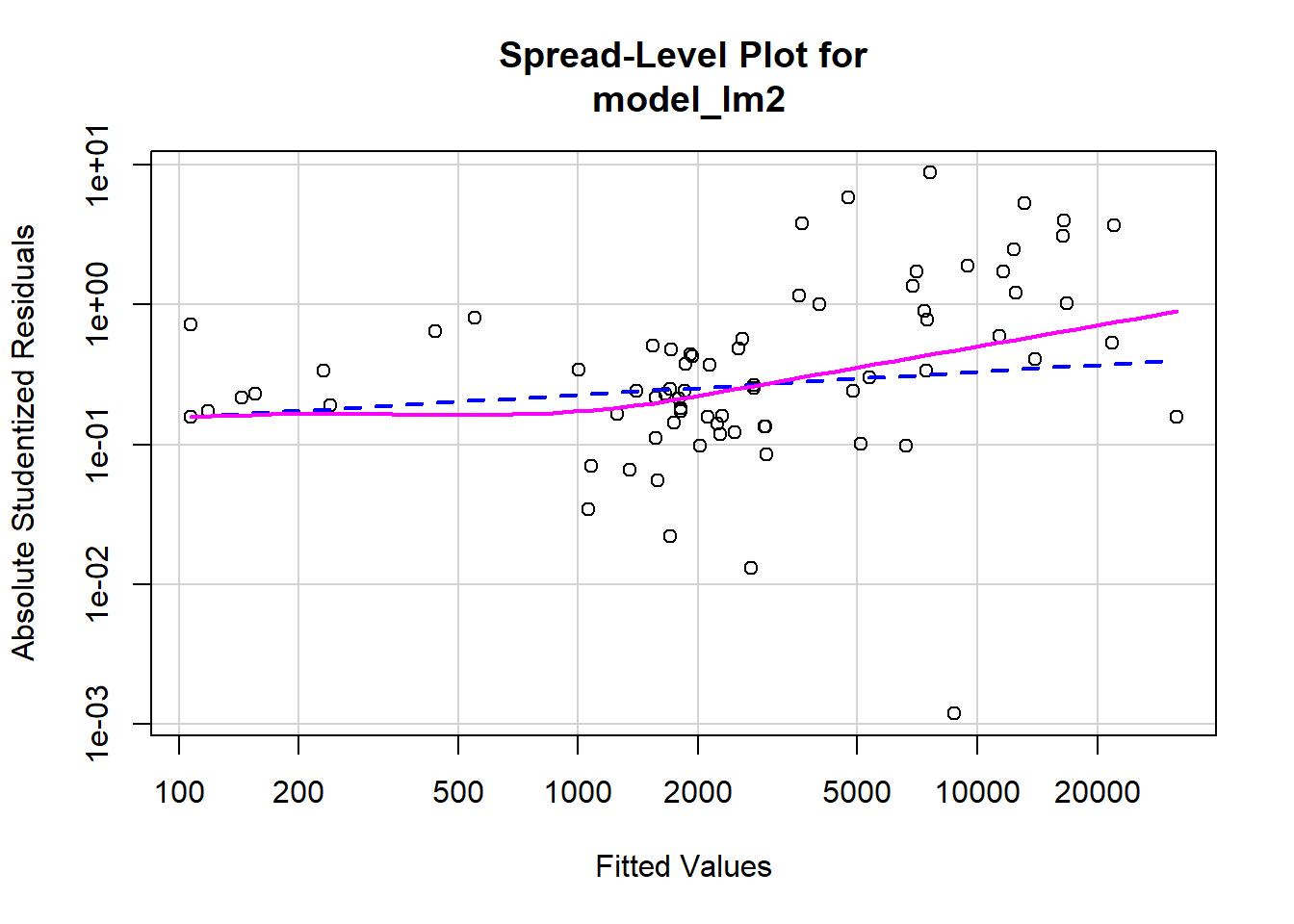

Homoscedasticity

Suggested power transformation: 0.8360112Multicollinearity

kappa and vif are;

[1] 278.8081 purchases_cost_of_goods wages_sales_inside wages_warehouse

1.356649 1.637527 1.254097 [1] 1.416091 purchases_cost_of_goods wages_sales_inside wages_warehouse

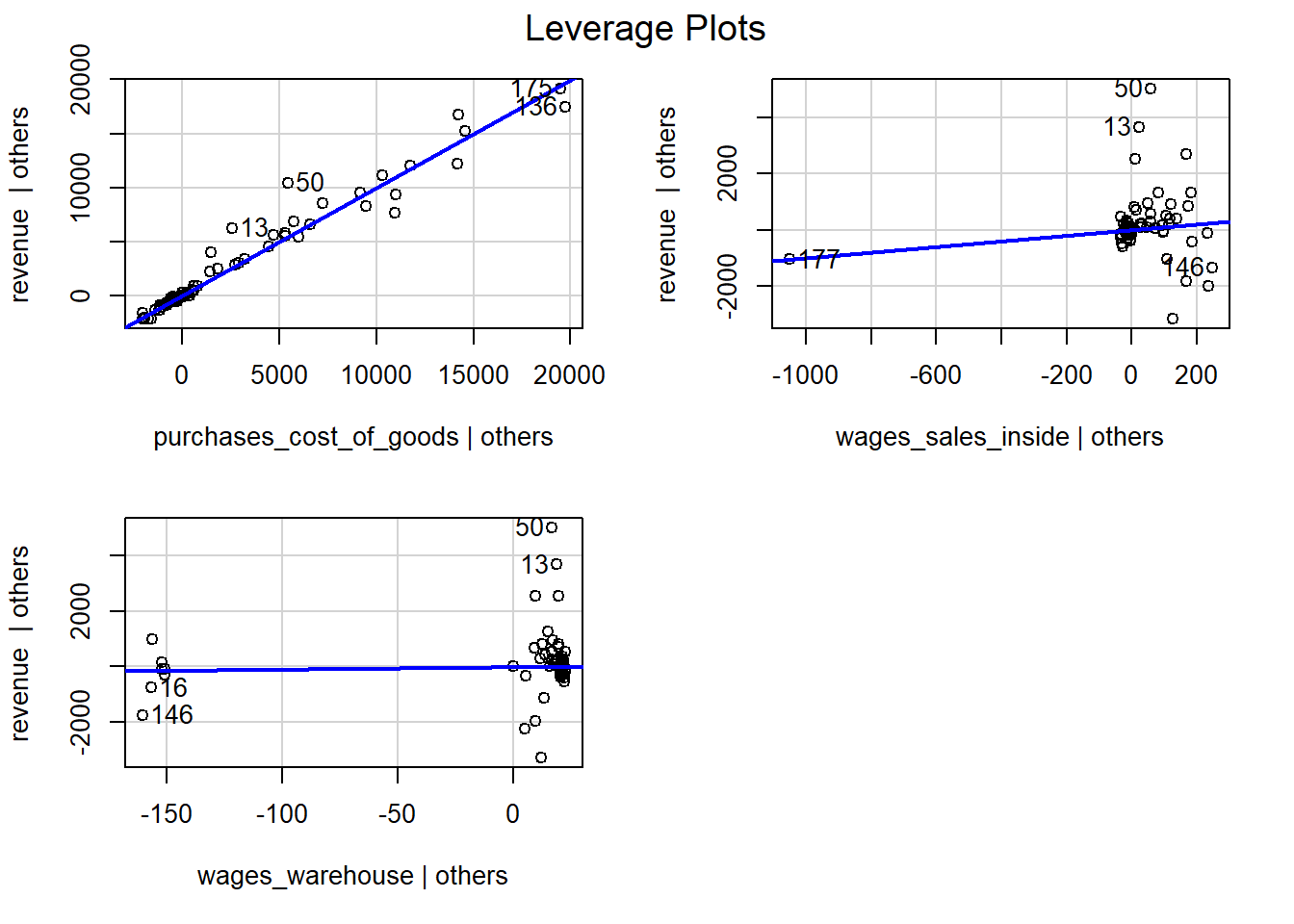

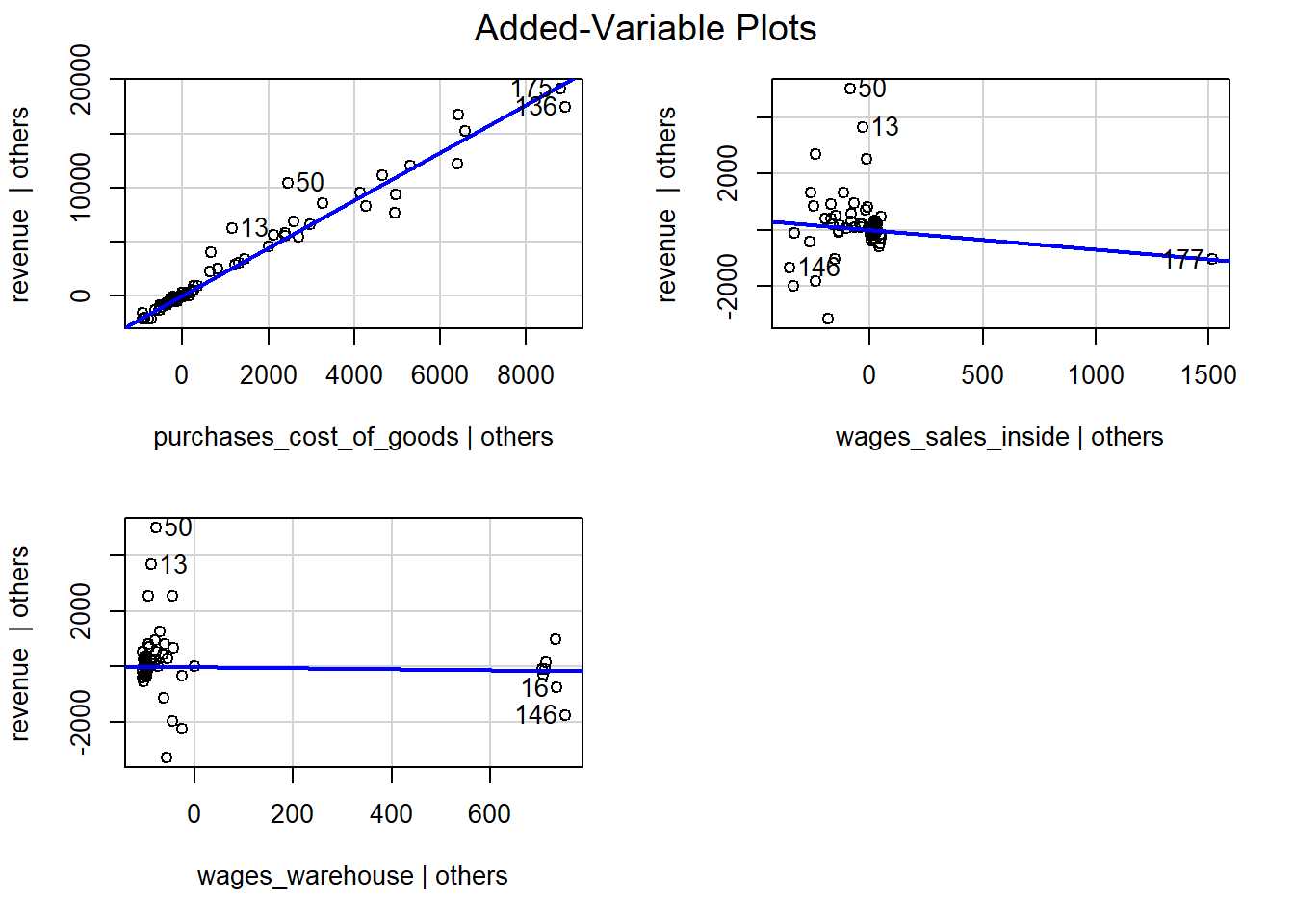

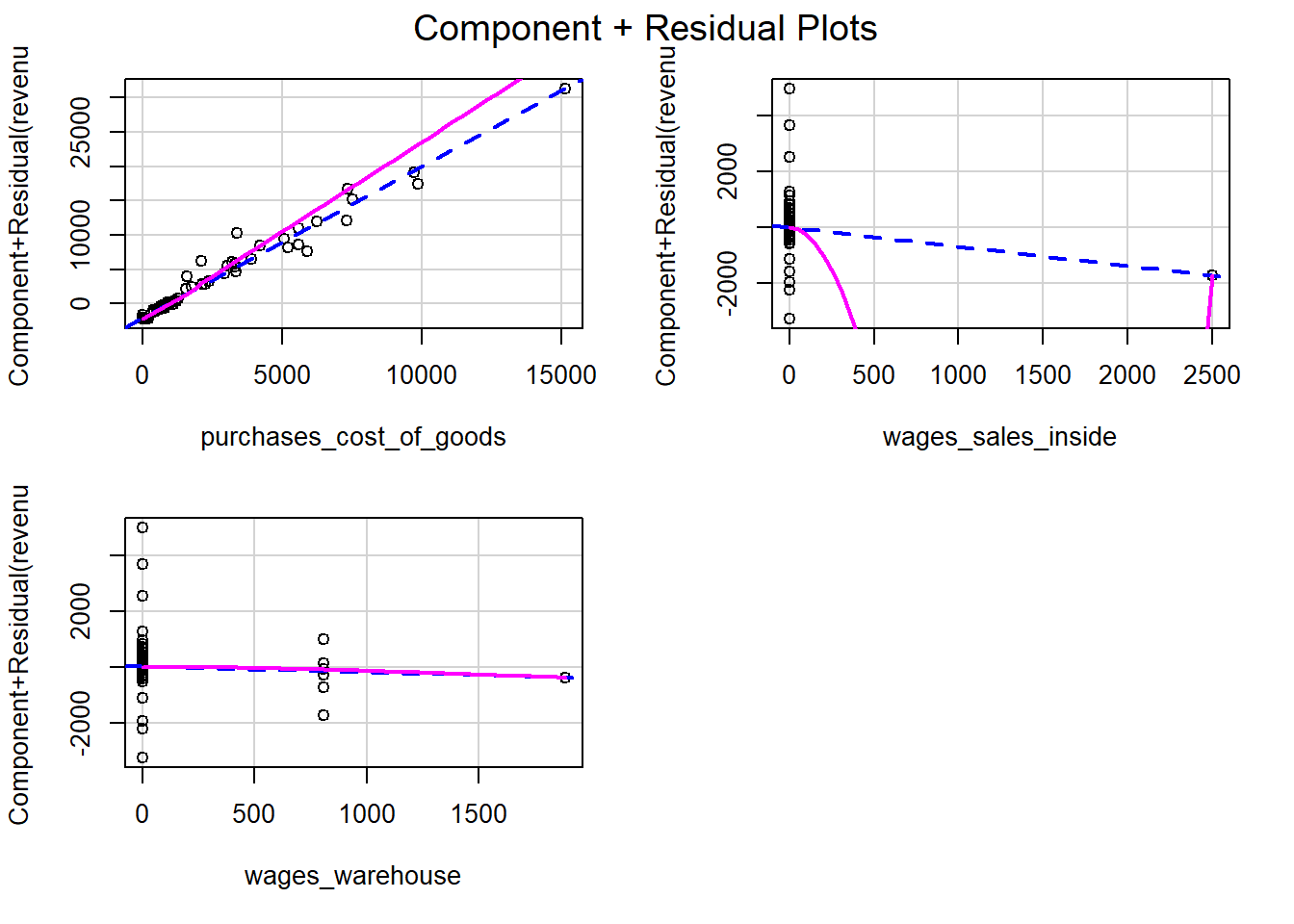

FALSE FALSE FALSENonlinearity

Linear hypothesis test

Hypothesis:

purchases_cost_of_goods = 0

wages_sales_inside = 0

Model 1: restricted model

Model 2: revenue ~ purchases_cost_of_goods + wages_sales_inside + wages_warehouse

Note: Coefficient covariance matrix supplied.

Res.Df Df F Pr(>F)

1 182

2 180 2 9149.1 < 2.2e-16 ***

---

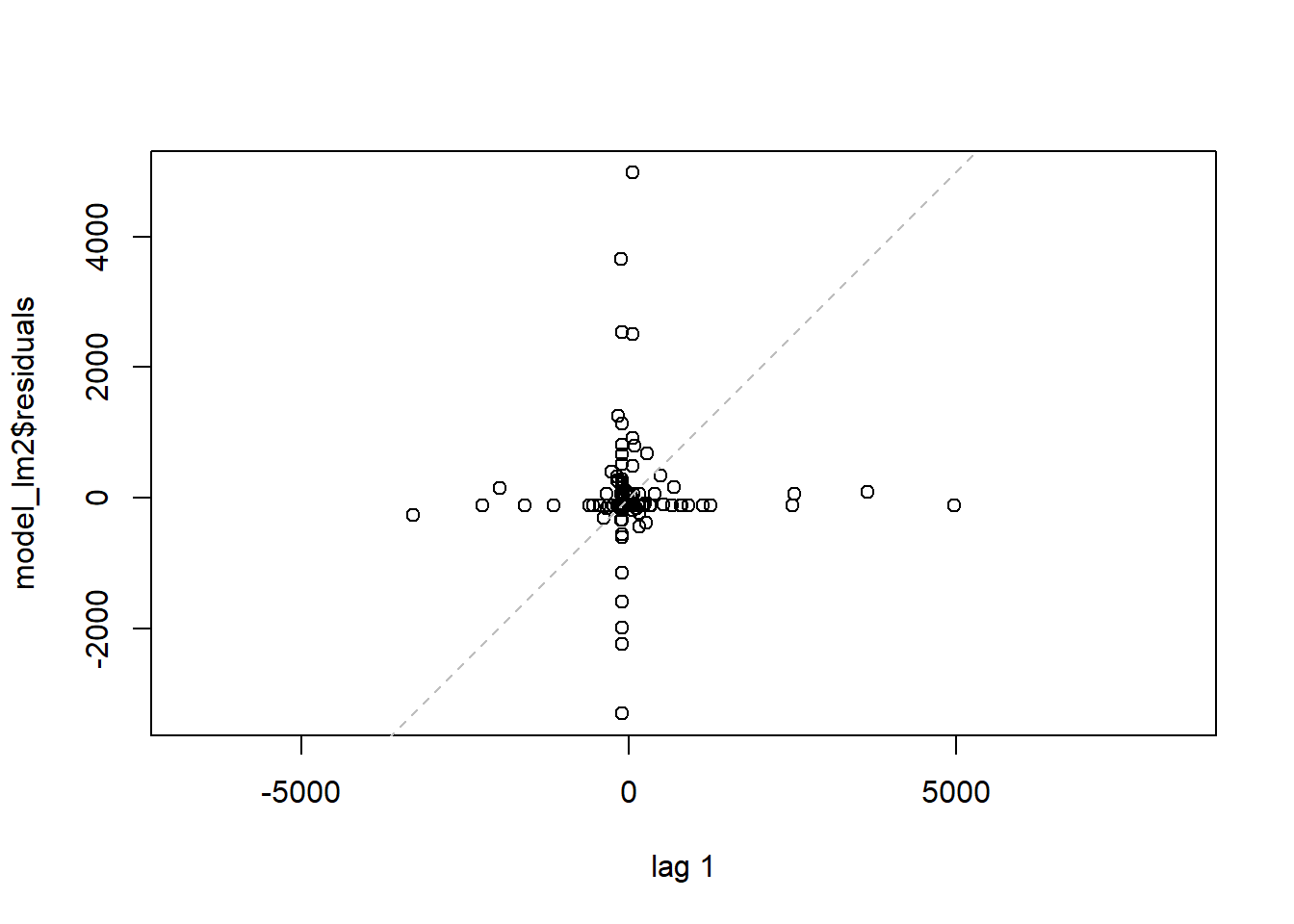

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Autocorrelation

lag Autocorrelation D-W Statistic

1 0.01769898 1.964331

Alternative hypothesis: rho0